Marketing & Advertising Expenses Are Tax Deductible

Marketing & Advertising — What’s Tax Deductible?

Are you in the hustle of completing your taxes? If you haven’t yet, did you know that most of your business’s marketing and advertising expenses can be tax deductible – as long as it’s ‘ordinary, necessary, and reasonable’.Ordinary, necessary, and reasonable – how does one know if it qualifies?

(I recommend consulting with your accountant or tax advisor, but here’s a quick little insight of things to consider.)

The IRS says you can deduct “reasonable advertising expenses that are directly related to your business activities.” In most cases, as long as you show a real business purpose for it, such as reaching customers, managing your brand, providing information about your products and services, etc., it can be counted.

Some examples of marketing expenses may include:

- Logo and branding

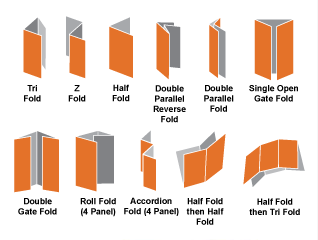

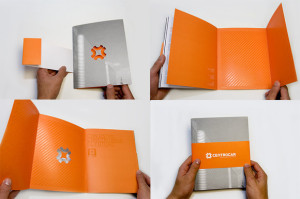

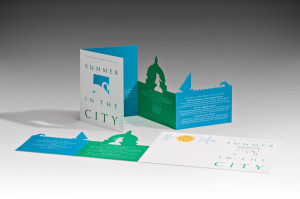

- Print advertising – brochures, business cards, banners, billboards, newsletters, magazine ads, mailers, thank you cards, etc. (However, certain ‘permanent’ signs may have to be spread out over time.)

- Online and digital advertising – radio, TV, online and social media ads, digital billboards, website design, hosting, SEO, videos and more.

- You can even deduct social media upkeep if you are paying someone outside your company.

- Giveaways, prizes and sponsorship

These are just a few things to consider when working on your taxes.

So don’t be afraid to spend a little money to help promote and boost your business. In the end, it is very likely that you can use it as a deduction to help ease your tax load.

Oh, and also be sure to ask your designer or adverting agency to provide receipts.

Disclaimer: I am no tax expert, and this information was gathered from multiple sources. I highly recommend speaking with your accountant and tax advisor to make sure your expenses qualify.